Having been lucky enough to invest in both tech (cloud, mobile, software) and “deeptech” (materials, cleantech, energy, life science) startups (and having also ran product at a mobile app startup), it has been striking to see how fundamentally different the paradigms that drive success in each are.

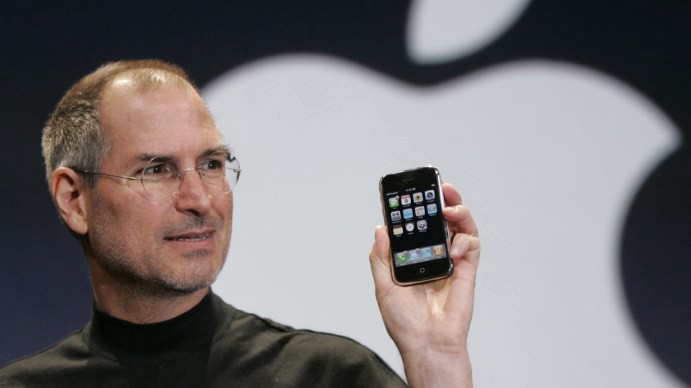

Whether knowingly or not, most successful tech startups over the last decade have followed a basic playbook:

- Take advantage of rising smartphone penetration and improvements in cloud technology to build digital products that solve challenges in big markets pertaining to access (e.g., to suppliers, to customers, to friends, to content, to information, etc.)

- Build a solid team of engineers, designers, growth, sales, marketing, and product people to execute on lean software development and growth methodologies

- Hire the right executives to carry out the right mix of tried-and-true as well as “out of the box” channel and business development strategies to scale bigger and faster

This playbook appears deceptively simple but is very difficult to execute well. It works because for markets where “software is eating the world”:

- There is relatively little technology risk: With the exception of some of the most challenging AI, infrastructure, and security challenges, most tech startups are primarily dealing with engineering and product execution challenges — what is the right thing to build and how do I build it on time, under budget? — rather than fundamental technology discovery and feasibility challenges

- Skills & knowledge are broadly transferable: Modern software development and growth methodologies work across a wide range of tech products and markets. This means that effective engineers, salespeople, marketers, product people, designers, etc. at one company will generally be effective at another. As a result, its a lot easier for investors/executives to both gauge the caliber of a team (by looking at their experience) and augment a team when problems arise (by recruiting the right people with the right backgrounds).

- Distribution is cheap and fast: Cloud/mobile technology means that a new product/update is a server upgrade/browser refresh/app store download away. This has three important effects:

- The first is that startups can launch with incomplete or buggy solutions because they can readily provide hotfixes and upgrades.

- The second is that startups can quickly release new product features and designs to respond to new information and changing market conditions.

- The third is that adoption is relatively straightforward. While there may be some integration and qualification challenges, in general, the product is accessible via a quick download/browser refresh, and the core challenge is in getting enough people to use a product in the right way.

In contrast, if you look at deeptech companies, a very different set of rules apply:

- Technology risk/uncertainty is inherent: One of the defining hallmarks of a deeptech company is dealing with uncertainty from constraints imposed by reality (i.e. the laws of physics, the underlying biology, the limits of current technology, etc.). As a result, deeptech startups regularly face feasibility challenges — what is even possible to build? — and uncertainty around the R&D cycles to get to a good outcome — how long will it take / how much will it cost to figure this all out?

- Skills & knowledge are not easily transferable: Because the technical and business talent needed in deeptech is usually specific to the field, talent and skills are not necessarily transferable from sector to sector or even company to company. The result is that it is much harder for investors/executives to evaluate team caliber (whether on technical merits or judging past experience) or to simply put the right people into place if there are problems that come up.

- Product iteration is slow and costly: The tech startup ethos of “move fast and break things” is just harder to do with deeptech.

- At the most basic level, it just costs a lot more and takes a lot more time to iterate on a physical product than a software one. It’s not just that physical products require physical materials and processing, but the availability of low cost technology platforms like Amazon Web Services and open source software dramatically lower the amount of time / cash needed to make something testable in tech than in deeptech.

- Furthermore, because deeptech innovations tend to have real-world physical impacts (to health, to safety, to a supply chain/manufacturing line, etc.), deeptech companies generally face far more regulatory and commercial scrutiny. These groups are generally less forgiving of incomplete/buggy offerings and their assessments can lengthen development cycles. Deeptech companies generally can’t take the “ask for forgiveness later” approaches that some tech companies (i.e. Uber and AirBnb) have been able to get away with (exhibit 1: Theranos).

As a result, while there is no single playbook that works across all deeptech categories, the most successful deeptech startups tend to embody a few basic principles:

- Go after markets where there is a very clear, unmet need: The best deeptech entrepreneurs tend to take very few chances with market risk and only pursue challenges where a very well-defined unmet need (i.e., there are no treatments for Alzheimer’s, this industry needs a battery that can last at least 1000 cycles, etc) blocks a significant market opportunity. This reduces the risk that a (likely long and costly) development effort achieves technical/scientific success without also achieving business success. This is in contrast with tech where creating or iterating on poorly defined markets (i.e., Uber and Airbnb) is oftentimes at the heart of what makes a company successful.

- Focus on “one miracle” problems: Its tempting to fantasize about what could happen if you could completely re-write every aspect of an industry or problem but the best deeptech startups focus on innovating where they won’t need the rest of the world to change dramatically in order to have an impact (e.g., compatible with existing channels, business models, standard interfaces, manufacturing equipment, etc). Its challenging enough to advance the state of the art of technology — why make it even harder?

- Pursue technologies that can significantly over-deliver on what the market needs: Because of the risks involved with developing advanced technologies, the best deeptech entrepreneurs work in technologies where even a partial success can clear the bar for what is needed to go to market. At the minimum, this reduces the risk of failure. But, hopefully, it gives the company the chance to fundamentally transform the market it plays in by being 10x better than the alternatives. This is in contrast to many tech markets where market success often comes less from technical performance and more from identifying the right growth channels and product features to serve market needs (i.e., Facebook, Twitter, and Snapchat vs. MySpace, Orkut, and Friendster; Amazon vs. brick & mortar bookstores and electronics stores)

All of this isn’t to say that there aren’t similarities between successful startups in both categories — strong vision, thoughtful leadership, and success-oriented cultures are just some examples of common traits in both. Nor is it to denigrate one versus the other. But, practically speaking, investing or operating successfully in both requires very different guiding principles and speaks to the heart of why its relatively rare to see individuals and organizations who can cross over to do both.

Special thanks to Sophia Wang, Ryan Gilliam, and Kevin Lin Lee for reading an earlier draft and making this better!

Thought this was interesting? Check out some of my other pieces on Tech industry